If I Go Under 100 Dollars With Bank of the West Debit How Long Do I Have to Get Over 100 Again

Introducing Standby Cash®

Apartment tire? Fridge need fixing? Cracked phone screen?

We know expenses add together up, emergencies happen, and sometimes coin gets tight. That'southward why we invented Standby Cash.

Huntington customers can qualify for a digital-simply $100 to $one,000 line of credit based primarily on their checking deposit history, non their credit score. Merely pay it back over three months. And, it's absolutely free when yous fix up automatic payments. Otherwise, a one% monthly interest charge (12% Apr) applies to the outstanding balances.†

Frequently Asked Questions

Three quick facts about Standby Cash

Does it affect your credit?

In one case yous open up Standby Greenbacks, the account and your activity (like how much of a line of credit y'all qualify for, how much of your line of credit you use, and on-time or late payments to your line of credit) are reported to credit bureaus, so information technology could positively or negatively affect your credit score.§

Acquire more

Can it help avoid overdraft fees?

In one case you open Standby Cash, yous tin can transfer money to your checking account earlier midnight Central Time the adjacent business day, while 24-Hour Grace¶ is in event, to comprehend your overdrafts and possible return transactions and avoid overdraft and return fees. Your Standby Greenbacks line volition be locked from further use until your account is no longer negative.‡

Learn more

![]()

Helps you live your life

Unexpected expenses? You can employ Standby Greenbacks to pay for emergencies that popular up or to get out of a fiscal tight spot.

Learn more than

How do I qualify for Standby Greenbacks?

To qualify for Standby Cash, yous demand $750 or more than in monthly deposits to a Huntington personal checking business relationship for three consecutive months, and an average daily residue of $200 or more in your checking account. Other eligibility requirements apply † . Standby Cash is bachelor to Huntington customers with a personal checking account. Detect the account that is best for yous and get started on your way to qualifying for Standby Greenbacks.

Compare Checking Accounts

Prepare to get your Standby Cash?

If you lot're already a Huntington checking customer, you lot're halfway there.

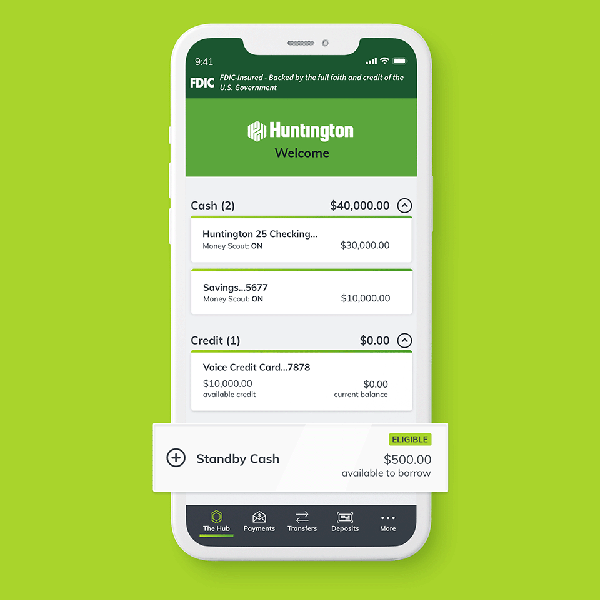

Log in to online banking or the Huntington Mobile app to meet if you lot qualify.

Open Standby Greenbacks with but a few clicks.

Standby Greenbacks is available for immediate transfer into your checking account.

Clicks or Taps? Either Way, We've Got Y'all.

Access Standby Cash by logging into your account using Huntington Online Banking or the Huntington Mobile App.

Download the App

Standby Greenbacks FAQ

General

What is Standby Greenbacks?

Answer: Standby Cash is a digital-only line of credit bachelor to Huntington customers based primarily on your checking and eolith history, non your credit score. Nosotros practice non check your credit score prior to you enrolling in Standby Cash, still once you enroll, nosotros will study account activity such as open date, line usage and payment history immediately subsequently enrolling. Information technology'due south money you tin can borrow on an ongoing ground, then long equally y'all remain eligible. Lines of credit allow you to utilize money, repay information technology, and then apply information technology again without needing to reapply. Eligibility for Standby Cash is based on your account balances, monthly deposits, and overdrafts. In order to see if you are eligible for Standby Greenbacks, customers will need to enroll in online banking at Huntington.com. For eligible customers who have enrolled in Standby Greenbacks - money can be transferred immediately into your Huntington deposit account and will need to be repaid over 3 months. If you lot pay dorsum with automatic payments, at that place are no interest or fees. Without automatic payments, there is one% monthly interest on your current balance (12% Apr).

How does Standby Greenbacks work?

Answer: Upon qualifying for Standby Cash, you have the option to open a Standby Greenbacks account. Once opened, yous can transfer any corporeality up to your Standby Greenbacks credit limit into your account. To pay dorsum Standby Greenbacks free of interest, simply gear up upwardly automated payments, and pay dorsum the amount you lot transferred over three months. Without automatic payments, at that place is ane% monthly involvement on your current balance (12% APR). In one case the money is paid back, it's available to use again and then long as you lot maintain eligibility.

Why would Huntington do this?

Answer: Managing coin isn't always like shooting fish in a barrel, there are times when coin gets tight - we created Standby Cash to help. Nosotros empathize unpredictability and what our customers go through. We're for people, and our mission is to reinvent banking so that information technology looks out for people, just like you.

Eligibility

How practice I qualify for Standby Greenbacks?

Answer: At a high level:

- An open up checking business relationship with a minimum of $750 deposited each month for iii consecutive months

- Enrolled in online banking

- Average daily balance of $200 or more in your checking business relationship for the past 30 days

- None of your Huntington accounts overdrawn for more than 24 hours

- Do not have an active or contempo defalcation or other legal procedure

- All account holders above the age of 18.

- Your physical address on file must be in footprint (Ohio, Colorado, Illinois, Indiana, Kentucky, Michigan, Minnesota, Pennsylvania, South Dakota, Wisconsin, and Westward Virginia).

- A U.S. Denizen or not-U.S. Citizen with a Social Security Number or Taxation-ID.

How do I know if I am eligible for Standby Greenbacks?

Answer: Login to online banking at huntington.com or the Huntington Mobile App to bank check eligibility. Expect for Standby Cash nether your Credit section on The Hub. If you are eligible, nosotros will evidence your available line amount in that location.

I'm a new Huntington client, how long before I know if I'k eligible for Standby Cash?

Answer: Standby Greenbacks is available to customers once they reach all eligibility requirements, including having $750 or more than in monthly deposits for three consecutive months, and an average daily residue of $200 or more in your checking account for the past xxx days.

My Standby Cash credit limit changed, why?

Answer: Standby Cash credit limits are determined based on your deposit activeness, account balances, and overdraft history at each statement cycle. Y'all volition receive an warning via electronic mail and/or text notifying y'all of any changes to your credit limit. Message and data rates may apply.

I already used Standby Cash once, can I utilize it again?

Reply: Yeah! As long as y'all go along to encounter eligibility requirements, you can utilize Standby Greenbacks as many times as yous demand. If you employ 90% or more than of your Standby Cash credit limit at any point over three consecutive argument cycles, your Standby Cash business relationship volition exist suspended until the entire remainder is paid off.

How long is my Standby Cash account good for/how long exercise I have access to it? When does it shut?

Answer: Your Standby Cash account remains open as long as you remain eligible and your qualifying deposit account remains open up. If you want to shut the Standby Cash account, contact us at 800-480-2265.

What happens if I close my qualified checking account, do I however have admission to my Standby Cash account?

Reply: No. If you lot close your qualified checking account, you will no longer take access to make boosted transfers from your Standby Cash account. Your Standby Greenbacks account will exist visible until your outstanding balances are paid off. Once paid off in full, your Standby Cash account will be closed.

Payments

How do I repay my Standby Cash line of credit?

Respond: You tin can make your payments through transfers within online banking, or you can gear up automatic payments. Pay it back over three months using automated payments, and it's free. Otherwise, a one% monthly interest accuse (12% April) applies to the outstanding balances.

Can I pay off Standby Cash early?

Answer: Yes, customers can make payments at any time within The Hub in online banking.

What if my Standby Cash payment is late?

Answer: You'll get an alert via email and/or text before your payment is due, and some other alarm if a payment is past due. Bulletin and data rates may apply. If your account has a past due amount, you won't exist able to transfer any more than coin from Standby Cash. You can still brand payments though. Failure to pay tin can result in account default and closure. We report account activity to credit bureaus, and so your apply could positively or negatively affect your credit score. To make it more convenient, set up automatic payments so y'all don't have to worry about remembering payment dates.

What happens if I don't have plenty money in my account for automatic payments?

Answer: Automatic payments won't overdraw your business relationship. Withal, automatic payments reduce the amount of money in your account to encompass other transactions, so you should ensure your account has sufficient funds. If your account remainder doesn't encompass an automatic payment on the day it is due, we'll automatically endeavor the payment again when y'all have sufficient funds.

Ane of my accounts is overdrawn. What happens to my Standby Cash line of credit?

Respond: If you already opened your Standby Greenbacks account and 24-60 minutes Grace® is in effect, you tin can utilise Standby Cash to cover your overdraft. Standby Cash will non automatically embrace an overdraft, then be sure to take action as soon as possible by transferring money from your Standby Greenbacks account to cover your overdrawn account by midnight the side by side concern 24-hour interval. If you lot qualified but haven't opened a Standby Cash business relationship yet, you can open and apply your Standby Cash to cover your overdraft while the 24-Hour Grace window is in effect. If your account is overdrawn for more than than one day, yous won't be able to open a Standby Greenbacks account or transfer money from an open Standby Cash account until your overdrawn account is restored to a positive rest.

Are there really no fees or interest on Standby Cash?

Answer: To skip the interest and enjoy Standby Cash admittedly free, set up automatic payments. Otherwise, you'll pay a 1% monthly interest accuse (12% Apr) on your electric current balance at each statement. To avert interest, prepare automated payments before five p.thou. ET on your statement date. If your statement date falls on a weekend or holiday, update your settings by v p.m. ET the previous business twenty-four hour period.

Credit Information

How does opening a new account impact your credit?

Answer: Opening a new account may cause your credit score to fluctuate. Although nosotros don't look at your credit score to make up one's mind eligibility, the Standby Cash line of credit will be reported to credit bureaus as a new account. New debt may cause your credit score to drop. But equally you continue making on-time payments on your new account, your responsible debt management will as well be reflected in your credit report. As a issue, you might meet your score rebound.

How does your account balance/utilization charge per unit impact your credit score?

Reply: We report the Standby Cash line of credit and its current balance to the credit bureau inside 1–2 weeks after opening an business relationship. Utilization rate is the pct of bachelor credit you're using, and information technology'due south an important gene in determining your credit score. College utilization rates tin hurt your score, lower utilization rates can help.

How does your payment history impact your credit score?

Respond: Missed payments tin take a negative impact on your credit score. Lenders want to exist certain you lot tin can pay back debt on fourth dimension when they are considering you for new credit. On-time payments demonstrate you tin manage new debt responsibly and credit scores may better with positive payment history.

What are primal factors for ongoing management of your credit score?

Answer:

| Weight | Primal Factor (FICO® #) | Behavior Tips |

| 35% | Payment History | Make payments on time. Enroll in automatic payments. |

| xxx% | Credit Usage | Keep your credit utilization ratio low (less than xxx% of your bachelor credit is recommended). |

| 15% | Credit History Length | The longer your credit history, the higher your credit score may exist. |

| 10% | Credit Mix | Comport a diverse portfolio of credit accounts, which might include a mix of machine loans, credit cards, educatee loans, mortgages, or other credit products. |

| 10% | New Credit | Too many accounts or inquiries can signal increased take a chance and could lower your score. |

Can I asking a higher credit limit?

Reply: Standby Cash credit limits are based on your deposit activity, account balances, and overdraft history. While you can't request a change, you might go eligible for a higher amount based on your account activity. If you demand access to more money, talk to your Huntington broker nigh other options like a personal loan.

Is there a limit to how much of the Standby Greenbacks account I tin can utilize?

Answer: You tin transfer whatever amount of Standby Cash, from $i to your total Standby Cash credit limit. You tin brand multiple transfers and pay back each transfer in equal installments over three months. If yous use 90% or more of your Standby Greenbacks at any indicate three months in a row, your account may exist suspended until yous pay back the full amount you lot've used. Don't forget that a loftier credit utilization charge per unit (the amount of total bachelor credit that you are using) has the potential to negatively impact your credit score.

What is a line of credit and how does it piece of work?

Answer: A line of credit is coin you lot can borrow on an ongoing footing. With a line of credit, you lot can accept access to funds every bit needed, inside a predetermined credit limit. Lines of credit permit you to use money, repay it, and and then use information technology once again without needing to reapply.

What does 12% April mean?

Reply: April stands for Annual Percentage Rate. It is the corporeality of interest you will pay annually on money that y'all borrow. If you practice non set up automatic payments to repay your Standby Cash, yous will pay a 1% monthly involvement accuse (12% Apr) on outstanding balances.

Contact Us

We're hither for you — online, by phone, or in a co-operative.

Automatic Banana

Quick answers when you demand them

Speak with United states of america

Nosotros are here to assistance

Detect a Branch

Discover your nearest Huntington Co-operative

†Standby Greenbacks is discipline to terms and atmospheric condition and other business relationship agreements. A 1% monthly interest accuse (12% Almanac Pct Rate) will be added to outstanding balances if automatic payments are not scheduled. Bachelor through online banking or the Huntington Mobile app to individuals with an agile consumer checking account with at least 3 months of consistent deposit activity of $750 or more, and an boilerplate daily residuum of $200 or more. Other eligibility requirements apply. An active or recent bankruptcy or other legal process may disqualify you. Line amount and ongoing availability may vary based on changes to your deposit action, boilerplate daily balance, and number and length of overdrafts on whatever of your Huntington eolith accounts. When whatsoever of your Huntington eolith accounts are in an overdraft condition for more than one twenty-four hours, your Standby Cash line may be suspended until they are no longer negative. If ninety% or more than of the approved credit line is drawn iii months in a row, Standby Cash will be suspended until it'due south paid to a zero residual. Concern checking accounts are not eligible for Standby Cash.

‡Standby Cash may simply exist used to gear up an overdraft or eligible render while 24-Hour Grace® is available for those transactions. If any of your checking or deposit accounts remain overdrawn for more than than 1 twenty-four hour period, your admission to Standby Cash may be suspended. One time your accounts are no longer overdrawn, your admission to Standby Greenbacks may be reinstated.

§Although nosotros volition non utilize your credit score to make up one's mind eligibility, once you open up Standby Greenbacks we will brainstorm to report the business relationship and your activity to the credit bureaus. Standby Cash may positively or negatively affect your credit score.

¶Your account will be automatically closed if information technology remains negative in any amount for lx days, including if your account is overdrawn within our $50 Prophylactic Zone. Learn more at huntington.com/SafetyZone and huntington.com/Grace.

#My FICO. Accessed 2021.

FICO® is a registered trademark of the Fair Isaac Corporation in the U.s.a. and other countries.

24-Hour Grace® and Standby Cash® are federally registered service marks of Huntington Bancshares Incorporated. The 24-Hour Grace® system and method is patented. U.S. Pat No. 8,364,581, 8,781,955, 10,475,118, and others pending. $fifty Safety ZoneSM is a service mark of Huntington Bancshares Incorporated.

Source: https://www.huntington.com/Personal/checking/standby-cash

0 Response to "If I Go Under 100 Dollars With Bank of the West Debit How Long Do I Have to Get Over 100 Again"

Post a Comment